How Late Payments Affect Your Credit Score and Mortgage Approval in New Jersey

Understanding the impact of late payments on credit scores and mortgage eligibility. Learn the severity levels, recovery timelines, and proven strategies to rebuild credit and qualify for a home loan in New Jersey.

A single late payment can feel like a minor oversight—perhaps you forgot to set up autopay, or an unexpected expense threw off your budget. However, the consequences of late payments extend far beyond late fees. They can significantly damage your credit score, jeopardize your ability to qualify for a mortgage, and cost you thousands of dollars in higher interest rates over the life of a loan. Understanding how late payments impact your credit, the severity levels based on how late the payment is, and the timeline for recovery is essential for anyone planning to buy a home in New Jersey.

The good news is that late payment damage is not permanent. While the negative mark remains on your credit report for seven years, its impact diminishes significantly over time, especially as you build a consistent history of on-time payments. Mortgage lenders focus heavily on recent payment history—typically the past 12 to 24 months—which means you can recover from past mistakes and still qualify for competitive mortgage rates. This guide provides New Jersey homebuyers with a comprehensive understanding of late payment consequences, recovery strategies, and specific steps to rebuild credit and achieve mortgage approval.

Understanding Late Payment Reporting

Not all late payments are reported to credit bureaus, and understanding the reporting thresholds is crucial. Most creditors do not report a payment as late to the credit bureaus until it is at least 30 days past the due date. This means if you make a payment 15 or even 25 days late, you will likely incur a late fee from your creditor, but it typically will not appear on your credit report or affect your credit score. However, once a payment reaches 30 days past due, creditors are required to report it to the three major credit bureaus—Experian, Equifax, and TransUnion—and the damage to your credit score begins.

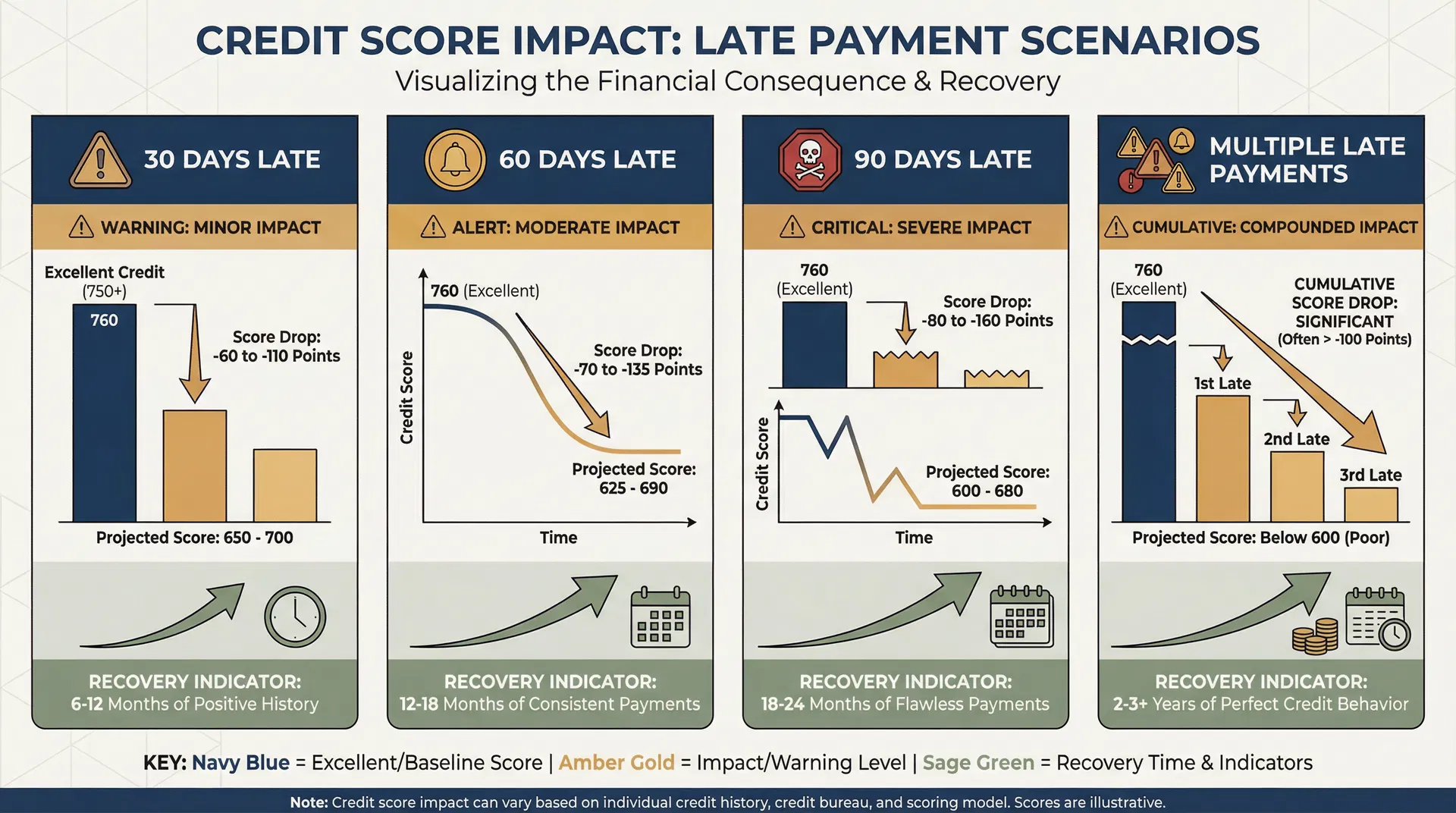

The severity of the impact increases as the payment becomes more delinquent. Credit bureaus categorize late payments into specific buckets: 30 days late, 60 days late, 90 days late, 120 days late, and eventually charge-off or collection status. Each escalation level causes additional damage to your credit score. For mortgage lenders, the presence and recency of late payments are critical factors in underwriting decisions. A single 30-day late payment from three years ago will have minimal impact, while multiple recent late payments or any payment 60+ days late will raise serious red flags and may result in mortgage denial.

Credit Score Impact by Late Payment Severity

The amount your credit score drops from a late payment depends on several factors: your starting credit score, the severity of the late payment (30, 60, or 90+ days), the type of account (mortgage, credit card, auto loan), and your overall credit history. Generally, individuals with higher credit scores experience larger point drops because they have more to lose. Someone with a 780 credit score might drop 90 to 110 points from a single 30-day late payment, while someone with a 680 score might drop 60 to 80 points from the same infraction.

| Late Payment Severity | Credit Score Drop (Excellent Credit 750+) | Credit Score Drop (Good Credit 680-749) | Mortgage Impact |

|---|---|---|---|

| 30 Days Late | -60 to -110 points | -60 to -80 points | Moderate impact; explainable if isolated |

| 60 Days Late | -70 to -135 points | -70 to -105 points | Significant impact; requires strong explanation |

| 90+ Days Late | -80 to -160 points | -80 to -130 points | Severe impact; may disqualify from conventional loans |

| Multiple Late Payments | Cumulative damage, often >100 points | Cumulative damage, often >100 points | Critical impact; likely mortgage denial without recovery period |

How Mortgage Lenders View Late Payments

Mortgage underwriters scrutinize payment history more closely than almost any other credit factor because it directly predicts future payment behavior. Lenders want to see a consistent pattern of on-time payments, particularly in the 12 to 24 months leading up to the mortgage application. The presence, recency, and severity of late payments all factor into the underwriting decision. A single 30-day late payment from three years ago on a credit card will have minimal impact on your mortgage approval, especially if you can provide a reasonable explanation and demonstrate flawless payment history since then.

However, recent late payments—particularly within the past 12 months—raise serious concerns. Most conventional loan programs require no late payments on any credit accounts in the 12 months prior to application. FHA and VA loans are slightly more lenient, often allowing one or two isolated 30-day late payments in the past year if you can document extenuating circumstances. Late payments on housing-related accounts (mortgage, rent) are viewed much more seriously than late payments on credit cards or auto loans because they directly indicate your ability to prioritize housing payments.

Mortgage Program Requirements for Late Payments

| Loan Program | Late Payment Tolerance | Housing Payment Requirements | Recovery Timeline |

|---|---|---|---|

| Conventional | No late payments in past 12 months preferred | No mortgage/rent late payments in 12 months | 12 months clean history after late payment |

| FHA | 1-2 isolated 30-day lates allowed with explanation | No mortgage/rent 60+ day lates in 12 months | 6-12 months clean history depending on severity |

| VA | Similar to FHA; considers extenuating circumstances | No mortgage/rent 60+ day lates in 12 months | 6-12 months clean history depending on severity |

| USDA | No late payments in past 12 months preferred | No housing late payments in 12 months | 12 months clean history after late payment |

Credit Recovery Timeline After Late Payments

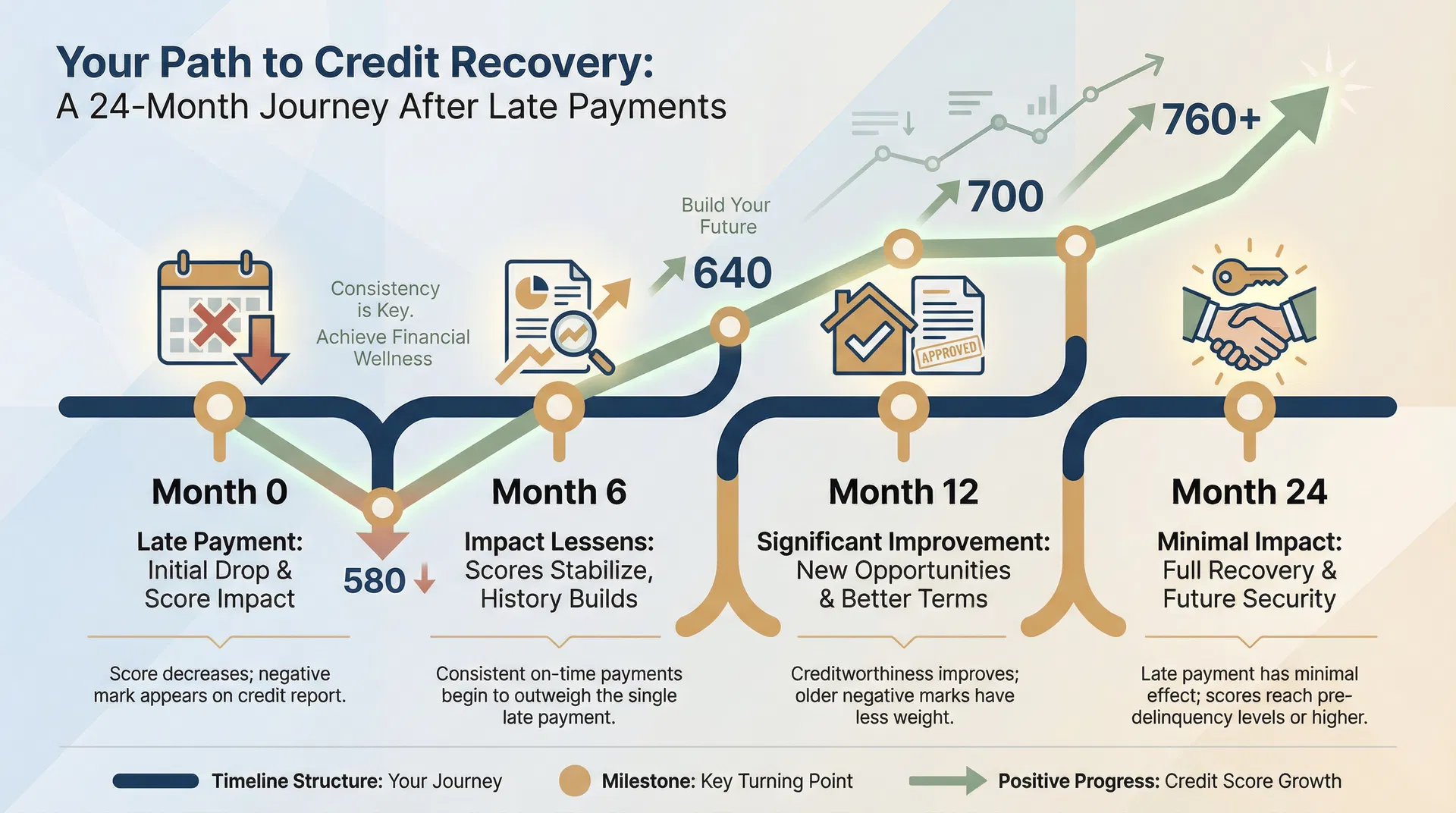

The impact of a late payment on your credit score diminishes over time, particularly as you build a consistent history of on-time payments. While the late payment remains on your credit report for seven years from the date it was first reported, its influence on your credit score decreases significantly after the first year. Credit scoring models like FICO and VantageScore place much greater weight on recent payment behavior, meaning a late payment from two years ago has far less impact than one from two months ago.

For mortgage qualification purposes, demonstrating 12 to 24 months of flawless payment history after a late payment is typically sufficient to overcome the negative mark, especially if the late payment was an isolated incident with a reasonable explanation. The key to recovery is consistency—making every single payment on time, keeping credit card balances low, avoiding new late payments, and demonstrating financial responsibility. The timeline below illustrates the typical recovery journey after a late payment and how your credit score and mortgage eligibility improve over time.

Month 0-6: Initial Impact

Credit score drops significantly. Late payment appears on credit report. Focus on making all future payments on time and avoiding additional late payments. Mortgage approval unlikely during this period.

Month 6-12: Stabilization

Credit score begins to recover as positive payment history accumulates. Impact of late payment lessens. FHA/VA loans may become available with strong compensating factors and explanations.

Month 12-24: Significant Improvement

Credit score substantially recovered. One year of clean payment history established. Conventional loans become accessible. Better interest rates available as creditworthiness improves.

Month 24+: Minimal Impact

Late payment has minimal effect on credit score. Two years of positive history established. Full range of mortgage products available at competitive rates. Past mistake largely overcome.

Strategies to Rebuild Credit After Late Payments

Recovering from late payments requires a systematic approach focused on rebuilding positive credit history, demonstrating financial responsibility, and avoiding additional negative marks. The most important factor is time combined with consistent on-time payments. Every month of perfect payment history dilutes the impact of the late payment and strengthens your overall credit profile. However, there are specific strategies you can implement to accelerate your credit recovery and position yourself for mortgage approval.

1. Make All Future Payments On Time

This is the single most important step in credit recovery. Set up automatic payments for at least the minimum amount due on all credit accounts to ensure you never miss another payment. Payment history accounts for 35% of your FICO credit score—the largest single factor—so consistent on-time payments are essential. Consider setting payment reminders a few days before due dates as a backup to autopay, and review your accounts regularly to ensure payments are processing correctly.

2. Reduce Credit Card Balances Below 30%

Credit utilization—the percentage of available credit you're using—is the second-largest factor in your credit score at 30%. Keeping balances below 30% of your credit limits demonstrates responsible credit management and can boost your score significantly. Ideally, aim for utilization below 10% on each card and overall. Paying down high balances not only improves your credit score but also reduces your debt-to-income ratio, making you a stronger mortgage candidate.

3. Dispute Inaccurate Late Payment Reporting

Review your credit reports from all three bureaus (Experian, Equifax, TransUnion) to verify that late payments are accurately reported. If you find errors—such as a payment reported as 60 days late when it was actually only 30 days late, or a late payment reported after you made the payment on time—you have the right to dispute these inaccuracies. File disputes directly with the credit bureaus online, providing documentation such as bank statements or payment confirmations. Successful disputes can remove or correct late payment marks, improving your credit score.

4. Request Goodwill Adjustment from Creditor

If you have a strong payment history with a creditor and the late payment was an isolated incident, you can write a goodwill letter requesting that they remove the late payment from your credit report. Explain the circumstances that led to the late payment (illness, job loss, family emergency), emphasize your long history of on-time payments, and express your commitment to maintaining the account in good standing. While creditors are not obligated to honor goodwill requests, many will consider them, especially for long-term customers with otherwise excellent payment records.

5. Add Positive Payment History

If you have limited credit history, consider adding new positive tradelines to dilute the impact of the late payment. Options include becoming an authorized user on a family member's credit card with excellent payment history, opening a secured credit card and using it responsibly, or taking out a credit-builder loan. Each month of positive payment history on these accounts strengthens your overall credit profile and demonstrates your ability to manage credit responsibly.

Preparing for Mortgage Application with Late Payments

If you have late payments on your credit report and are planning to apply for a mortgage, preparation is key. Lenders will require a written explanation for any late payments, particularly those within the past two years. Your letter of explanation should be concise, honest, and focused on the circumstances that led to the late payment and the steps you've taken to prevent future occurrences. Avoid making excuses or blaming others; instead, take responsibility and demonstrate that you've resolved the underlying issue.

Additionally, gather documentation to support your explanation. If the late payment resulted from a medical emergency, provide medical bills or insurance statements. If it resulted from job loss, provide termination letters and proof of new employment. If it was a one-time oversight, demonstrate your otherwise perfect payment history. The more evidence you can provide that the late payment was an anomaly rather than a pattern, the more likely the underwriter will approve your mortgage application.

Compensating Factors That Strengthen Your Application

Even with late payments on your credit report, you can strengthen your mortgage application by demonstrating compensating factors that reduce the lender's risk. These include a larger down payment (20% or more), significant cash reserves (six months or more of mortgage payments in savings), low debt-to-income ratio (below 36%), stable employment history (two years or more with the same employer), and strong income growth trajectory. Each of these factors demonstrates financial stability and reduces the likelihood of future payment problems.

Important Consideration

If you're currently struggling to make payments, contact your creditors immediately to discuss hardship programs, payment plans, or deferment options. Many creditors offer assistance programs that can prevent late payments from being reported to credit bureaus, protecting your credit score and mortgage eligibility.

Frequently Asked Questions

How long does a late payment stay on my credit report?

Late payments remain on your credit report for seven years from the date they were first reported. However, their impact on your credit score diminishes significantly over time, especially as you build positive payment history. After 24 months, the effect on your credit score is minimal.

Can I get a mortgage with a recent late payment?

Yes, but it depends on the severity, recency, and number of late payments. FHA and VA loans are more lenient than conventional loans and may approve borrowers with one or two isolated 30-day late payments in the past 12 months if you can provide a reasonable explanation and demonstrate compensating factors.

Will paying off the late account remove it from my credit report?

No. Paying off an account with a late payment brings it current and stops additional late fees and interest, but the historical late payment mark remains on your credit report for seven years. However, having the account current is better than leaving it delinquent, and it may improve your mortgage approval chances.

How much does a late payment affect my mortgage interest rate?

The impact varies based on the severity and recency of the late payment. A single 30-day late payment from over a year ago may have minimal impact on your rate. However, recent or multiple late payments can lower your credit score by 60-160 points, potentially increasing your interest rate by 0.25% to 1.0% or more, costing thousands over the life of the loan.

Should I close credit cards after paying them off to improve my credit?

No. Closing credit cards reduces your available credit, which increases your credit utilization ratio and can lower your credit score. It also reduces the average age of your credit accounts. Keep cards open and use them occasionally for small purchases that you pay off immediately to maintain positive payment history.

Your Path Forward

Late payments are setbacks, not permanent barriers to homeownership. With time, consistent on-time payments, strategic credit rebuilding, and proper preparation, you can overcome past mistakes and qualify for a mortgage in New Jersey. The key is to start immediately—every month of positive payment history brings you closer to your homeownership goals. Focus on the factors you can control: making all payments on time, reducing debt, building savings, and maintaining stable employment.

If you're planning to buy a home and have late payments on your credit report, working with an experienced mortgage professional who understands credit challenges is essential. They can review your specific situation, recommend the best loan program for your circumstances, help you prepare a strong letter of explanation, and guide you through the underwriting process. Don't let past mistakes prevent you from achieving your dream of homeownership—take action today to rebuild your credit and position yourself for mortgage approval.

Ready to Overcome Credit Challenges and Buy Your Home?

Let's review your credit situation, discuss your mortgage options, and create a personalized plan to achieve homeownership in New Jersey—even with past late payments.

Related Articles

How to Get a Home Renovation Loan in New Jersey: Complete 2026 Guide

Comprehensive guide to financing your home improvements in New Jersey. Learn about FHA 203(k), HomeStyle, VA renovation loans, and qualification requirements.

Strategic Guide to Timing Your Home Sale

Learn how to balance tax implications, market conditions, seasonal factors, and personal circumstances for optimal home selling timing.

Capital Gains Tax on Home Sales: Complete Guide

Understanding and minimizing capital gains tax when selling your home in New Jersey. Learn about the $250K/$500K exclusion and tax-saving strategies.