How to Get a Home Renovation Loan in New Jersey: Complete 2026 Guide

Comprehensive guide to financing your home improvements in New Jersey. Learn about FHA 203(k), HomeStyle, VA renovation loans, qualification requirements, and the complete application process to transform your property.

Whether you need to fix structural issues with plumbing, electrical systems, and roofing, or you want to build up your property value, improve energy efficiency, and create your dream home, financing is the critical first step. For New Jersey homeowners and buyers, home renovation loans offer a powerful solution that combines purchase or refinance costs with improvement financing into a single, streamlined mortgage.

As a mortgage professional who has guided hundreds of New Jersey buyers through successful renovation projects, I have witnessed firsthand how strategic buyers leverage renovation financing to secure better deals, expand their housing options, and create personalized living spaces. While fewer homes may be listed during certain seasons or in competitive markets, renovation loans allow you to look beyond move-in-ready properties and consider the substantial inventory of older homes and fixer-uppers that offer tremendous value potential.

New Jersey's housing market presents unique opportunities for renovation financing. The state's older housing stock, established neighborhoods with character homes, and high property values make renovation loans particularly relevant for buyers who want to invest in quality locations while customizing their living space. This comprehensive guide explains everything you need to know about renovation loans, from understanding different loan types to navigating the qualification and application process.

Understanding Home Renovation Loans

A home renovation loan is a specialized type of mortgage that includes funds for purchasing or refinancing a home along with financing for renovations and repairs. This innovative financing structure allows borrowers to combine the costs of buying a home and funding its improvements into a single loan, streamlining the process and potentially saving thousands of dollars on closing costs and interest rates compared to taking out separate loans.

Consider a common scenario: you are house hunting in New Jersey and cannot quite find the perfect home that hits all your needs and wants. You love a particular town with excellent schools, convenient commuting access, and a strong community, but the available homes do not match your vision. With a renovation loan, you can purchase a home in your desired location and remodel it into your dream home—all with one loan, one closing, and one monthly payment.

Alternatively, if you are a current homeowner who wants to upgrade your amenities, add space for a growing family, or modernize outdated systems, you could refinance with a renovation loan to turn your existing home into the perfect residence. This means you can move into your dream home without actually moving, preserving your established neighborhood connections, school districts, and community ties.

The Benefits of Renovation Financing

Single Loan Convenience

Purchase a home and secure funds for renovations, from basic repairs to room additions, all in one 30-year fixed-rate mortgage with a single closing and one monthly payment.

Potential Cost Savings

Save on closing costs and interest rates compared to taking out separate loans for purchase and improvements, potentially saving thousands over the life of the loan.

No Out-of-Pocket Expenses

No need to spend additional cash on upfront renovations; improvement costs are covered in the loan, preserving your savings for furniture, moving costs, and emergencies.

Increased Home Value

Strategic renovations increase your home's value, potentially leading to higher equity and greater return on investment when you eventually sell.

Expand Your Search

Expand your home search to include competitively priced older homes and fixer-uppers in desirable New Jersey neighborhoods that you can renovate to your specifications.

Complete Personalization

Customize your home to your specific needs and preferences, from kitchen layouts to bathroom fixtures, creating a truly personalized living space that reflects your lifestyle.

Important Considerations

While renovation loans offer significant advantages, they require more preplanning than traditional mortgages. You must provide detailed renovation plans and cost estimates upfront, work with licensed contractors, and understand that combining purchase price and renovation costs leads to a larger loan amount and higher monthly payments. Renovation projects can also go over budget, so factor in a buffer for unexpected costs when calculating affordability. Additionally, these loans may have slightly higher interest rates and include origination fees, appraisal fees, and other closing costs.

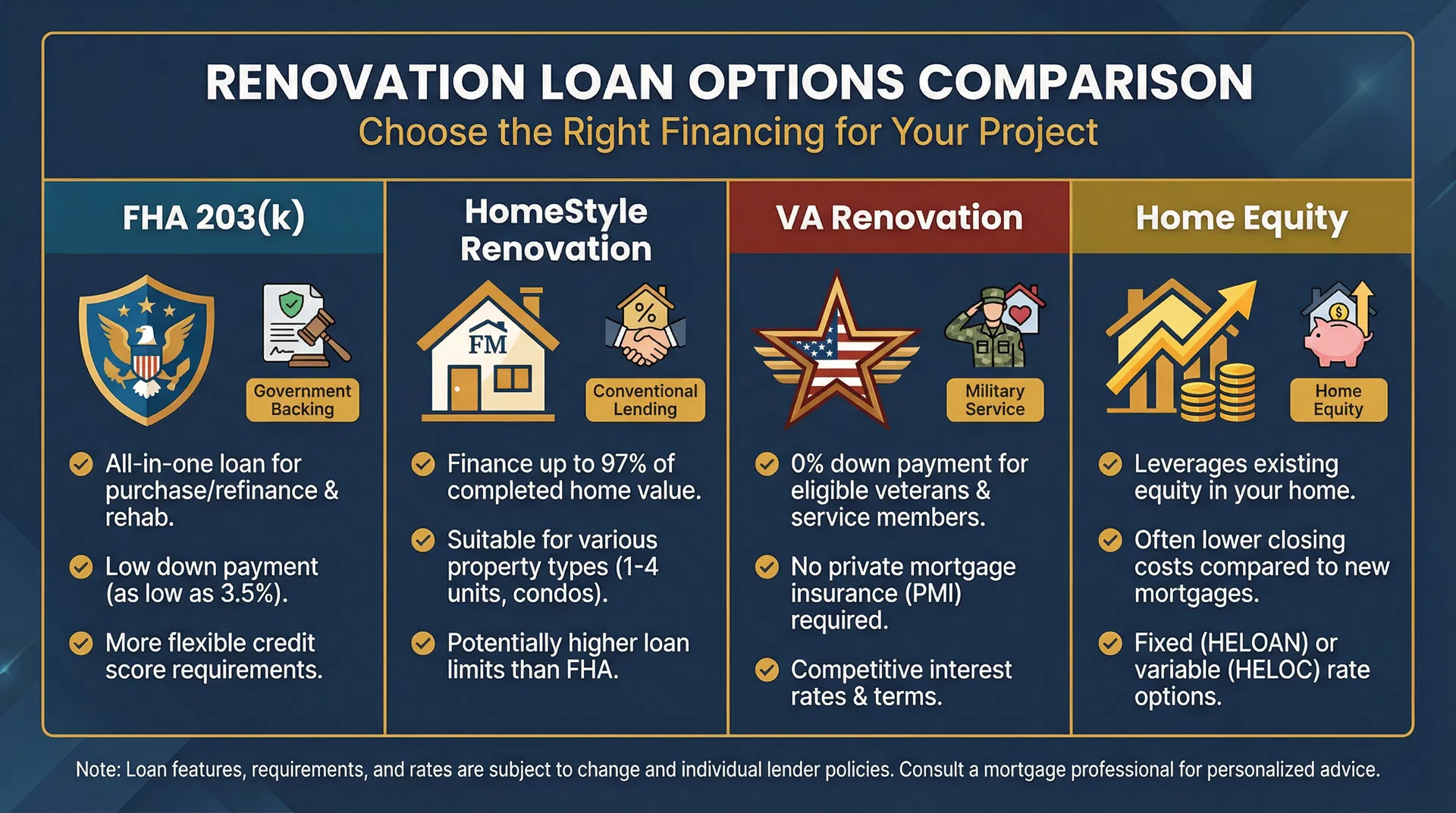

Types of Home Renovation Loans Available

Several types of home renovation loans exist, offered by both government and private institutions. Understanding the differences helps you choose the right financing option for your specific situation and renovation goals.

FHA 203(k) Rehabilitation Loan

The FHA 203(k) loan is backed by the Federal Housing Administration and represents one of the most accessible renovation financing options. This government-insured program lets homeowners combine their purchase or refinancing of a home with rehabilitation costs, all covered under a single mortgage agreement. The FHA 203(k) is particularly attractive for first-time buyers and those with lower credit scores, as it typically requires a minimum credit score of 580-620 and down payments as low as 3.5 percent.

Two versions exist: the Standard 203(k) for major structural renovations exceeding thirty-five thousand dollars, and the Limited 203(k) for smaller, non-structural improvements up to thirty-five thousand dollars. The Standard version requires a HUD consultant to oversee the project, while the Limited version has a simpler process. Both versions allow you to finance a wide range of improvements, from kitchen and bathroom remodels to roof replacement, HVAC upgrades, and accessibility modifications.

HomeStyle® Renovation Loan

Offered by Fannie Mae, the HomeStyle Renovation loan is a conventional financing option that allows owners to combine purchase costs and renovations in a single mortgage. This loan typically requires higher credit scores (usually 620 or above) and larger down payments (typically 5-10 percent) compared to FHA options, but it offers several advantages including higher loan limits and the ability to finance up to 97 percent of the completed home's value.

The HomeStyle loan is particularly suitable for various property types including single-family homes, condominiums, and even investment properties with up to four units. It allows for both major structural renovations and luxury upgrades like swimming pools and outdoor kitchens. Borrowers can choose their own contractors and have more flexibility in project scope compared to FHA 203(k) loans.

CHOICERenovation® Loan

The CHOICERenovation loan, offered by Freddie Mac, functions similarly to the HomeStyle loan as a conventional renovation financing option. It allows owners to combine purchase costs and renovations in a single mortgage with competitive terms and flexible renovation options. This loan typically requires credit scores of 620 or higher and offers financing for a wide range of property types and improvement projects.

VA Renovation Loan

Available exclusively to active-duty service members, veterans, and eligible surviving spouses, VA renovation loans incorporate home purchases and renovation costs into one agreement guaranteed by the Department of Veterans Affairs. The significant advantage of VA renovation loans is the zero down payment requirement for eligible borrowers, along with competitive interest rates and no private mortgage insurance (PMI) requirement.

VA renovation loans can be used for both purchase and refinance transactions, allowing eligible borrowers to buy fixer-uppers or upgrade their existing homes. The loan covers repairs, improvements, and alterations, though luxury items may have restrictions. For New Jersey's substantial veteran population, this represents an excellent opportunity to maximize home buying power while creating a personalized living space.

Alternative Financing Options

Beyond purchase-based renovation loans, homeowners with existing equity have additional financing options. Home equity loans provide fixed-rate lump sums that allow owners to borrow against their home equity to finance renovations, typically with lower interest rates than personal loans or credit cards. Home equity lines of credit (HELOCs) offer flexible credit lines with variable interest rates, allowing homeowners to draw funds as needed during the renovation process.

Cash-out refinances allow homeowners to take out a new mortgage for an amount higher than their current balance, receiving the difference in cash that can be used for renovations. This option works well when current interest rates are favorable or when homeowners want to consolidate debt while funding improvements. Each option has distinct advantages depending on your equity position, credit profile, and renovation timeline.

Qualifying for a Home Renovation Loan

Understanding qualification requirements helps you prepare a strong application and secure the most favorable terms. While specific requirements vary by loan type and lender, several key factors consistently influence approval decisions and loan terms.

Credit Score Requirements

Your credit score plays a crucial role in renovation loan approval and determines your interest rate and loan terms. A positive credit history makes everything easier, including getting approved, securing lower interest rates, and obtaining favorable terms like higher loan amounts and generous repayment periods. FHA 203(k) loans typically require minimum scores of 580-620, while conventional renovation loans (HomeStyle, CHOICERenovation) generally require 620 or higher for approval and 680-700 for the best rates.

Before applying, review your credit reports from all three bureaus (Equifax, Experian, TransUnion) and address any errors or issues. If your score is below optimal levels, consider taking several months to improve it by paying down credit card balances, making all payments on time, and avoiding new credit applications. Even a modest score improvement can save thousands of dollars in interest over the life of your loan.

Income and Employment Stability

Lenders need confidence that you can afford both the home purchase and renovation costs. Proving you have reliable sources of ongoing revenue makes lenders feel more secure that you will stick to your repayment schedule. Most lenders prefer to see at least two years of stable employment in the same field, though exceptions exist for recent graduates in high-demand professions or those with significant assets.

Your debt-to-income ratio (DTI), which compares your monthly debt obligations to your gross monthly income, is equally important. Most renovation loans require DTI ratios below 43-45 percent, though some programs allow higher ratios with compensating factors like excellent credit or substantial reserves. Calculate your DTI by dividing your total monthly debt payments (including the proposed mortgage) by your gross monthly income.

Home Equity and Collateral

For refinance-based renovation loans and home equity products, your existing equity serves as collateral. Lenders believe borrowers with substantial home equity pose fewer risks because if the owner defaults, lenders can use proceeds from the property's sale to recover the outstanding loan balance. Most home equity loans and HELOCs require at least 15-20 percent equity, while cash-out refinances typically require maintaining at least 20 percent equity after the transaction.

For purchase-based renovation loans, the property's after-renovation value serves as collateral. Lenders will order an appraisal that estimates the property's value after proposed improvements are completed, using this figure to determine the maximum loan amount. This approach allows buyers to finance properties that may currently appraise below the purchase price plus renovation costs, as long as the completed value supports the total loan amount.

Detailed Renovation Plans

The more information you can provide lenders about your renovation plans, the more transparent you will appear and the smoother your approval process will be. Transparency removes doubt about what you will do and how much you will spend, especially when you share backup plans in case certain renovations encounter unexpected issues. Your renovation plan should include detailed contractor bids, architectural drawings for structural changes, material specifications, and a realistic timeline for completion.

Work with licensed contractors to obtain written estimates that itemize labor and material costs. For major projects, consider hiring an architect or designer to create professional plans that demonstrate the feasibility and value of your proposed improvements. Lenders want to see that your renovation budget is realistic, that the improvements will increase the home's value, and that the project can be completed within the required timeframe (typically six months for FHA 203(k) loans).

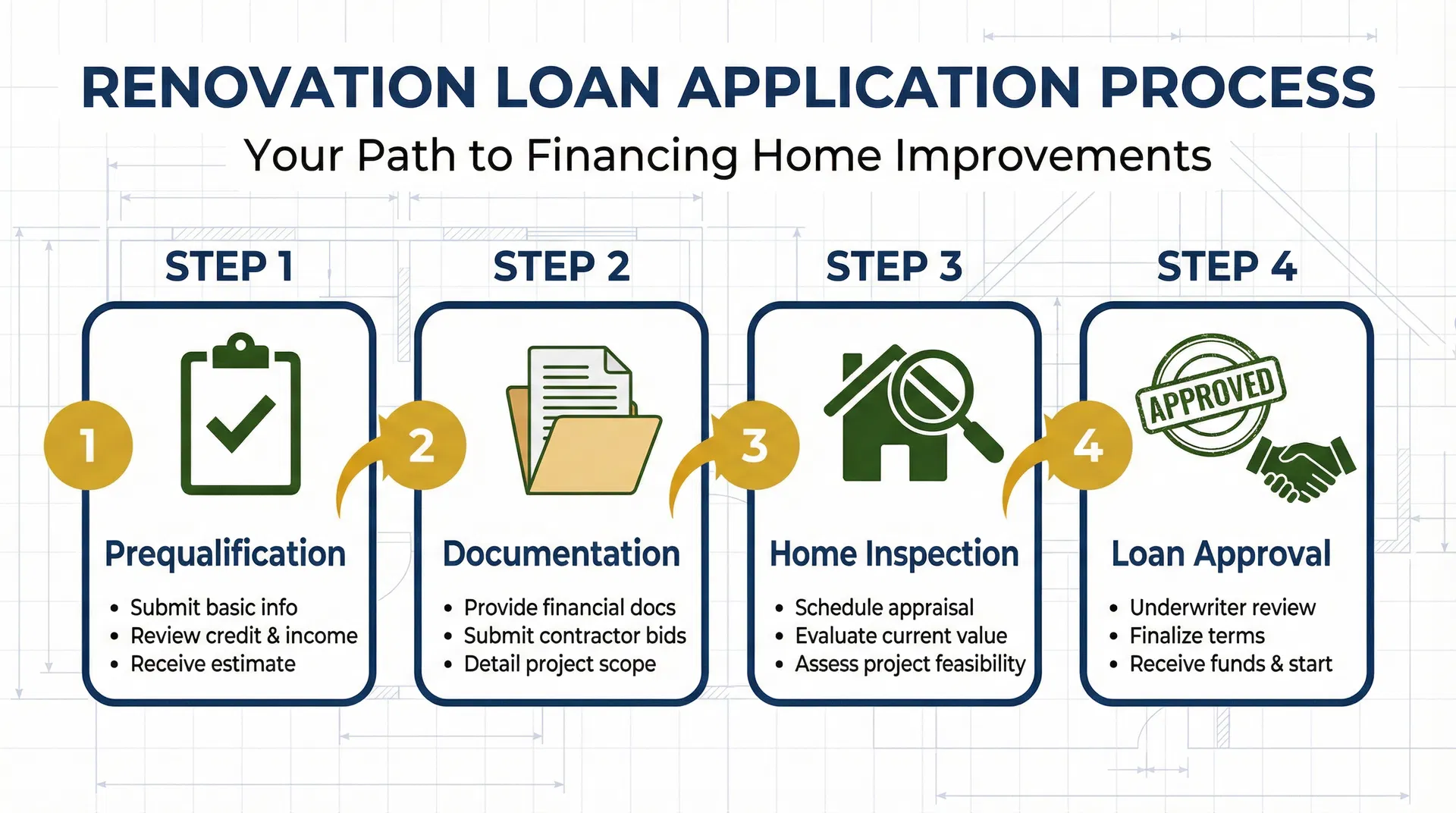

The Renovation Loan Application Process

Understanding the application process helps you prepare properly and avoid delays. While the specific steps vary slightly by loan type and lender, most renovation loan applications follow a similar four-phase structure.

Step 1: Prequalification

The prequalification phase begins with an initial inquiry where you provide basic information about your financial situation, renovation goals, and the property you are considering. You will submit to a soft credit check and present your current financial assets and liabilities. If successful, the lender will make a prequalification offer with an estimate of the loan amount and the interest rate they will charge.

Prequalifying offers significant advantages beyond just knowing your budget. It helps you learn what factors make you eligible for a loan, enables easier financial planning, and demonstrates to sellers that you are a serious buyer with financing in place. In competitive New Jersey markets, prequalification can make the difference between having your offer accepted or losing out to other buyers. Take this step seriously by providing accurate information and asking questions about any requirements you do not fully understand.

Step 2: Documentation

Once prequalified, you will need to provide comprehensive documentation to support your full application. Required paperwork typically includes personal identification documents (driver's license, Social Security card), income verification (recent pay stubs, W-2 forms, tax returns for the past two years), credit information, documentation of debts and assets (bank statements, investment accounts, retirement accounts), property deeds or purchase contracts, current mortgage statements if refinancing, and detailed home renovation plans with contractor bids.

Self-employed borrowers should be prepared to provide additional documentation including business tax returns, profit and loss statements, and possibly a letter from a CPA verifying income. Sufficient and well-organized documentation makes quicker approval more likely and may even have a positive effect on loan terms and interest rates. Create a checklist of required documents early in the process and gather everything systematically to avoid delays.

Step 3: Home Inspection and Appraisal

The home inspection represents a critical part of verifying the property's condition and the scope of improvement work. Professional inspectors should have ample experience with renovation loans, whether government-backed or privately disbursed. The inspector thoroughly examines every element of the property's interior and exterior, identifying cases of structural damage, potential code violations, and systems that need to be upgraded or replaced.

Once the inspection is complete, the inspector submits a detailed report covering the proposed renovations and any necessary improvements. This report directly informs the appraisal process, during which the property's value is assessed not just on its current state but also on the value it is expected to have after the proposed improvements are made. This future value, called the "after-improved value" or "as-completed value," plays a significant role in determining the loan amount.

The lender reviews the inspector's report and the appraisal to determine the appropriate loan amount, considering the increased value after renovations are completed and ensuring the loan covers both the purchase price and renovation costs. The lender may impose specific conditions based on the inspector's findings, such as mandatory repairs or upgrades to ensure the property's safety and compliance with building codes.

Step 4: Loan Approval and Closing

After all reviews are conducted and underwriting is complete, the lender may approve the loan. The lender may impose conditions that must be met before or shortly after the loan is given, such as providing additional documentation, completing specific repairs, or establishing escrow accounts for property taxes and insurance.

The final loan agreement reveals the loan amount, repayment terms, and interest rates attached to the loan. It will also detail closing costs, which might include origination fees, appraisal and inspection fees, title insurance, recording fees, and other incidental charges. Renovation loan closings typically take 45-60 days from application to closing, slightly longer than traditional mortgages due to the additional inspection and appraisal requirements.

After closing, renovation funds are typically held in an escrow account and disbursed in stages as work is completed and inspected. This protects both you and the lender by ensuring funds are released only when work meets quality standards and progresses according to schedule. You will work with your lender's construction department or a third-party consultant who will conduct periodic inspections and authorize fund disbursements to contractors.

Maximizing Success with Your Renovation Loan

Successfully navigating a renovation loan requires careful planning, realistic budgeting, and effective project management. Start by choosing the right loan type for your situation, considering factors like your credit score, down payment capacity, property type, and renovation scope. Work with experienced professionals including mortgage lenders familiar with renovation loans, licensed contractors with references and insurance, and potentially architects or designers for major projects.

Build a realistic budget that includes a contingency fund of at least 10-20 percent for unexpected issues that commonly arise during renovations. Prioritize improvements that add value and address safety or structural issues before cosmetic upgrades. Maintain detailed records of all expenses, contractor communications, and project progress to facilitate smooth fund disbursements and protect yourself in case of disputes.

For New Jersey homeowners and buyers, renovation loans represent a powerful tool for creating your dream home while building equity and investing in quality locations. Whether you are purchasing a fixer-upper in an established neighborhood or upgrading your current residence, understanding your financing options and following a structured approach will help you achieve your renovation goals efficiently and cost-effectively.

Ready to Explore Renovation Financing?

As a New Jersey mortgage professional specializing in renovation loans, I help buyers and homeowners navigate the complexities of renovation financing. Whether you are considering an FHA 203(k), HomeStyle, VA renovation loan, or home equity option, I can guide you through the process and help you secure the best terms for your situation.

Frequently Asked Questions

Can I do the renovation work myself to save money?

Most renovation loans require that work be completed by licensed contractors to ensure quality and compliance with building codes. However, you typically have the freedom to choose your own contractors and obtain competitive bids. Some minor cosmetic work may be permitted as DIY, but structural, electrical, and plumbing work must be done by licensed professionals.

How long do I have to complete the renovations?

Completion timeframes vary by loan type. FHA 203(k) loans typically require completion within six months, though extensions may be granted for complex projects. Conventional renovation loans (HomeStyle, CHOICERenovation) often allow up to twelve months. Your lender will establish a specific timeline based on your project scope and contractor estimates.

What types of renovations are eligible for financing?

Eligible renovations typically include structural repairs, room additions, kitchen and bathroom remodels, HVAC replacement, roof replacement, energy efficiency upgrades, accessibility modifications, and cosmetic improvements. Most loans prohibit luxury items like swimming pools (though some conventional loans allow them), and all improvements must be permanently attached to the property.

Can I live in the home during renovations?

This depends on the extent of renovations and loan type. For minor cosmetic improvements, living in the home is usually fine. For major structural work affecting safety systems (electrical, plumbing, heating), you may need to arrange temporary housing. FHA 203(k) loans have specific habitability requirements that must be met before you can occupy the property.

What happens if renovation costs exceed the original estimate?

Cost overruns are common in renovation projects. If costs exceed your original budget, you will need to cover the additional expenses out of pocket, as lenders will not increase the loan amount after closing. This is why building a 10-20 percent contingency fund into your initial budget is crucial. Work closely with contractors to obtain accurate estimates and monitor expenses throughout the project.

Related Articles

Strategic Guide to Timing Your Home Sale

Learn how to balance tax implications, market conditions, seasonal factors, and personal circumstances for optimal home selling timing.

Capital Gains Tax on Home Sales: Complete Guide

Understanding and minimizing capital gains tax when selling your home in New Jersey. Learn about the $250K/$500K exclusion and tax-saving strategies.

The Perks of Home Buying in the Winter Season

Discover the surprising advantages of buying a home during winter in New Jersey. Less competition, motivated sellers, and better deals await.